Bid Notice No. 004/2014

The Federal Democratic Republic of Ethiopia currently owns 100% equity of eleven businesses, which it intends to sell 100% ownership to an investor or a group of investors ready and capable of operating and developing them.

More information can be found on the following link.

Closing date for bids is April 22, 2014 at 3.00pm local time

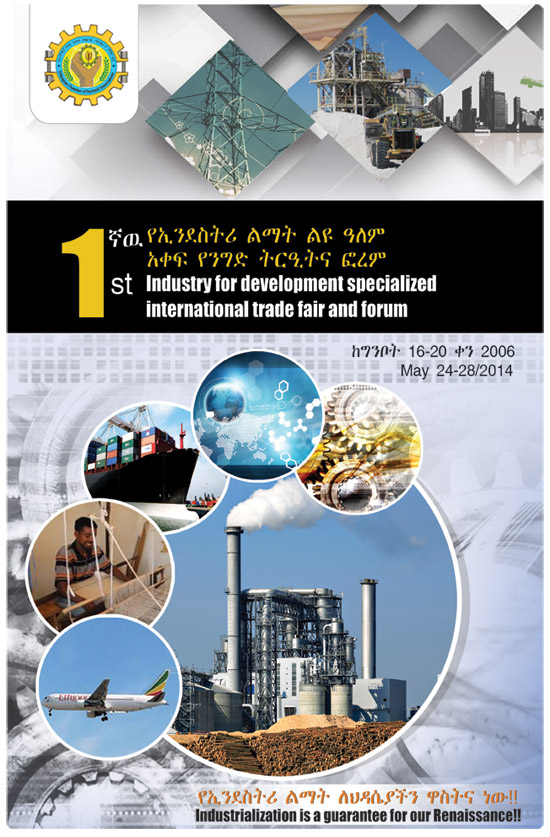

The Ethiopian Chamber of Sectoral Associations (ECSAS) is organizing the First Industry for Development Specialized International Trade Fair & Forum from 24 - 28 May at the Millennium Hall in Addis Ababa. The objectives of the fair among others is promoting Ethiopian products and services, strengthening linkages between various business actors and facilitating technology transfer and know-how to enhance competitiveness of local industries.

To register your participation, please fill in the registration form which can be found on the following link.

Further information can be found on the ECSAS website www.ethiocsa.com

Contact Information:

Developing Markets Associates, with the support of the Ethiopian Embassy, UK Foreign and Commonwealth Office and UKTI, will be hosting a high-level business mission to Ethiopia, enabling UK companies to gain comprehensive access to key decision-makers at a business and government level. Mark Simmonds, UK Minister for Africa, will join the mission to outline the growing cooperation between the governments.

Mission delegates will learn at first hand from government officials, led by HE Prime Minister Desalegn, and businesses about new and extended trade & investment opportunities across a range of commercial sectors in both countries. The UK companies present will themselves have the opportunity to raise their own profiles with government and the private sector at a time when Ethiopia is indicating a strong wish to engage more closely with UK.

More information can be found on the following link or contact:

Trade and Investment

Ethiopia has adopted a free market economic policy in 1992, and in line with this has promoted private investment. With the introduction of market economy, Ethiopia has implemented a number of reforms including the privatization of state owned enterprises, liberalization of foreign trade, deregulation of domestic prices, and devaluation of the exchange rate. The Birr has been fairly stable undergoing a gradual devaluation from 6.8 Birr per U.S. Dollar. Ethiopia's exchange rate has remained fairly stable due to the government's appropriate monetary policies and considerable foreign exchange reserves.

With its enormous resources, the country has untapped investment opportunities, huge market access and low cost of doing business. The country has excellent climate, fertile soil and huge domestic raw material base. Its location is strategic that makes it close to the lucrative markets of the Middle East, Asia and Europe.

Ethiopia's current road density is 30% per thousand kilometers with a plan to further the road density by 41% between 2002 and 2007. This in effect brings about significant quality improvement in import-export routes and other all-weather roads on major national routes. The air transport and the shipping line are also providing efficient services. Air transport cost for general cargo export is about USD 4.26/kg and USD 5.26/kg to Europe and USD 8.35/kg to North America, whereas, for general cargo import the fare is USD 5.25/kg from Europe and USD 16.73/kg from North America.

The pre capita power production is 28 KWh and the government is planning to increase hydropower capacity of the country. The current tariff on electric power ranges between 0.41-0.57. Hydropower generation of electricity has also recently been opened up to private foreign investors. The state-owned telecommunication service envisages increasing the number of telephone lines over 760,000 with the aim of raising the lines to 12 lines per 1,000 persons.

The political situation of the country is stabilized. In Ethiopia, the labor force is estimated at 40 million, and labor remains readily available and inexpensive. The cost of labor is very low in Ethiopia with a wage of USD 1 a day for unskilled labor and average monthly salary of USD 90 for a fresh graduate. Ethiopia has enacted a liberal investment law and the Ethiopian Investment Commission has been established, which is making every effort in creating an enabling environment for investment. The conducive economic environment encouraged foreign direct investment. The data indicate that for the period between 1992 and 2005 a total of 13,125 investors with an aggregate capital of 151.5 billion Birr have been licensed; out of which 1,358 are foreigners with an aggregate capital of 38.9 billion Birr.

The country has currently reformed its investment code by broadening the sector coverage for foreign participation. Accordingly, the newly included sectors are telecommunication, power and air services. Thus, almost all sectors are open for foreign investors.

Nowadays, investors are no more expected to go to various government offices to get their applications approved. The Ethiopian Investment Commission (EIC) is now serving as one stop-shop facilitator, issuing investment permit, work permit, residence permit and allocation of land for investment.

Investment Incentives

Investors are eligible for investment incentives. Special incentive sectors and sub-sectors include agricultural development and agro-processing, agricultural production, manufacturing of equipment and machinery, spare parts, components and supplies, vehicle bodies, other products and assembly plants, and publishing of printed goods; large-scale road and building construction and other related works. Rural transportation facilities; and the purchase of spraying machinery, trucks fitted with refrigeration facilities, or other equipment for support services are also eligible for special incentive facilities.

An investor in one of these specified areas who meets the conditions for a qualifying investment certificate, and who produces evidence showing the exact amount of the capital invested within 30 days of commencement of operation, may qualify for incentives.

Incentives include:

- Exemption from payment of income tax for the period between 2 to 7 years depending on the area of investment, volume of exporting and the location of investment; 100% exemption from payment of import custom duties on all investment goods;

- Duty-free imports of spare parts up to 15% of the value of capital goods imported;

- Capital goods imported without the payment of import duties and other import taxes may be transferred to another investor enjoying similar privileges;

- Exemption from custom duties or other import taxes are granted on raw materials that are required in the production of export goods. Taxes and duties paid on raw materials are drawn back at the time of export of finished products. The duty drawback scheme applies to all taxed at the time of import, as well as those paid on local purchases.

- Exemption from any export taxes and other taxes levied on exports for Ethiopian products and services destined for export;

- Carrying forward of losses during a tax exemption period for half of the tax holiday period after the expiry of the tax holiday;

- Export products from Ethiopia to the European Union are entitled to duty reductions or exemptions and are free from all quota restrictions under the Lome Convention. Trade preferences include duty-free entry of all industrial products and a wide range of agricultural products including fruits, vegetables, pulses and oil seeds. Under the Generalized system of Preference (GSP), a wide range of Ethiopia's manufactured products are entitled to preferential duty treatment in the USA, Canada, Switzerland, Norway, Sweden, Finland, Austria and Japan, as well as most European Union countries. Furthermore, no quantitative restrictions are applicable to Ethiopian exports on any of the 3,000-plus items currently eligible for Act (AGOA) & Everything But Arms (EBA) are the respective US and Europe export market opportunities open for exports from Ethiopia. The country has also access to 23 African countries through COMESA.

Investment Protection and Guarantee

The Government encourages foreign investors to invest in a broad range of industries which allows foreigners to hold up to 100% equity ownership. According to the investment Proclamation, investors are legally protected against the expropriation and nationalization of assets. In addition to this, Ethiopia has ratified the convention establishing the Multilateral Investment Guarantee Agency (MIGA) of the World Bank Group. It has also signed bilateral investment promotion agreements with a number of OECD (Organization for Economic Cooperation and Development) countries.

The investment proclamation allows all foreign investors, whether they receive incentives or not, to freely remit profits and dividends, principal and interest on foreign loans, and fees related to technology transfer. Foreign investors may also remit proceeds from the sale or liquidation of assets, from the transfer of shares or of partial ownership of an enterprise, and funds required for debt service or other international payments. The right of expatriate employees to remit their salaries is granted in accordance with the foreign exchange regulations of the National Bank of Ethiopia.

Investment Laws

Both foreign and domestic private entities have the right to establish, acquire, own, and dispose of most forms of business enterprises.

Land for investment purposes is obtained on lease and with prices set by periodic auctions. Land leasehold regulations vary in form and practice from region to region. Nonetheless, they all are best in attracting investments. Land could be obtained by paying nominal or fair charges. In some priority investment areas, land could be availed even free of charges. There are also industrial zones with adequate infrastructure facilities.

Ethiopia works hard to combat corruption through a combination of social pressure, cultural norms, and legal restrictions. Although corruption exists, it is not a significant hindrance to investment or trade in Ethiopia.

Labour Law

Ethiopia enjoys labor peace. The right to form labor associations and to engage in collective bargaining is granted by law. Workers who provide critical services like health care are not permitted to strike. The labour law has been revised to provide for strong work culture, discipline and efficiency while safeguarding basic labour rights.

Partnership

Foreign firms are welcome to invest in privatization efforts of the Ethiopian government.Since Ethiopia has launched the new market-oriented Economic Policy in 1992, it has embarked upon the privatization of state-owned enterprises as an integral part of the broader macro-economic reform.

Domestic and Foreign investors are encouraged to participate in the privatization process. In order to accomplish the privatization process, the former Ethiopian Privatization Agency is fused with the Public Enterprises Supervising Authority and has been re-established as Privation and Public Enterprises Supervising Authority (PPESA) since August 2004. Under PPESA there are well over 110 public enterprises for partnership and privatization in almost all sectors of the economy.

PPESA is also working towards attracting foreign private partners for joint venture, management contract and lease arrangements with public enterprises. This is in addition to sale option for public enterprises.

PPESA is looking for domestic/foreign public/private partners for most of the public enterprises it is supervising. In this regard, textile and garment, leather & leather products, food processing, construction and agro-industries are given priority for partnership. Those who are capable, experienced and committed investors are seriously looked for partnership. It is believed that working with the existing enterprises would reduce investment requirement and risks to new partners. There is also huge profit potential to be earned by proper utilization of time and resources. Of course, there is a challenge to be overcome.

Ethiopian Tannery

Privatization of public enterprises through competitive bidding and transparent negotiated sales are options available. Due considerations are given to expedite the process of privatization with ensuring transparency, fairness and public accountability. The sale option could be full or partial sale of shares as the case may be (see the annexed list of public enterprises for partnership and/or complete sale out options for shopping).